california competes tax credit carryforward

Creative Packaging Company Which Will Do Business in California as. How much in tax credits will be available each year.

Tax Season 2020 California Businesses And Individuals

You can download or print current or.

. This is a credit against the tax your business normally pays the Franchise Tax Board. January 3- 24 2022. In order to qualify for a portion of the allocation the business must have expansion plans to create jobs in California over the.

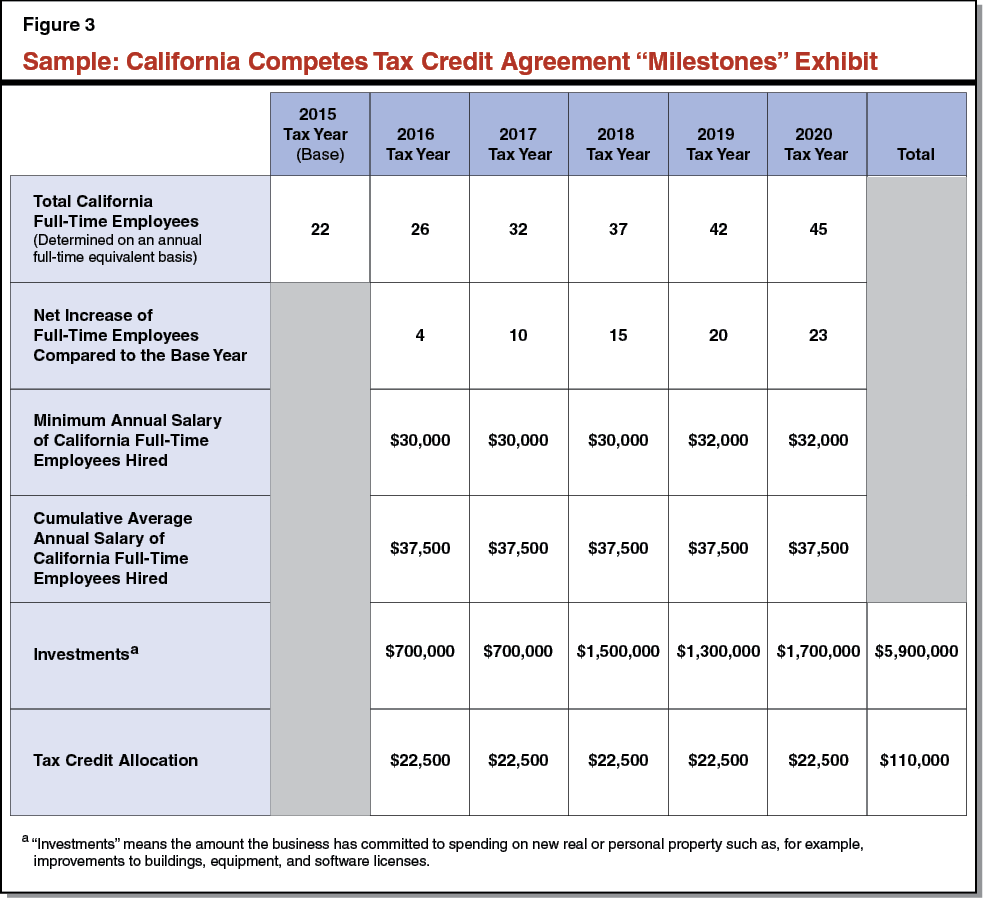

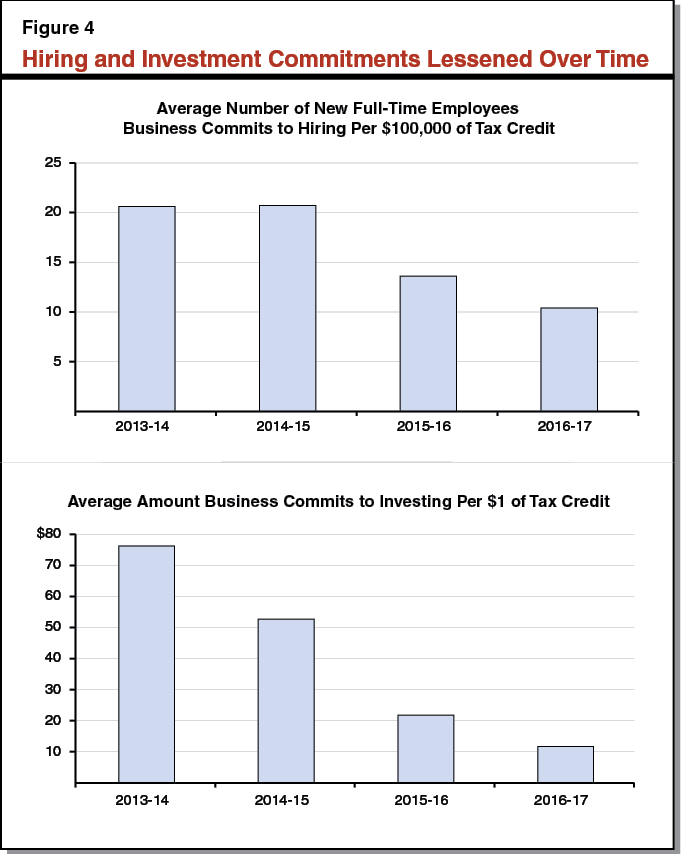

Applications for the credit will be accepted at calcompetescagov from July 26 2021 until August 16 2021. Through this 5-year agreement busin See more. Stay and grow in California Tax credit agreements are negotiated by the Governors Office of Business and Economic Development GO-Biz11and approved by the California Competes Tax Credit Committee.

The tentative amount of credits that can be allocated by GO-Biz is as follows. Total Tax Credit Awards. Use form FTB 3531 California Competes Tax Credit to report the credit amount for the current year the amount to carryover to future years and any amount recaptured.

The California Competes Tax Credit CCTC is an income tax credit available to businesses that want to locate in California or stay and grow in. Also use this form. Who Can Claim the California Competes Tax Credit.

The California Competes Tax Credit enables California businesses that expect to grow to request income tax credits to offset some of the costs of their increased payroll. The California Competes Tax Credit CCTC is an income tax credit available to businesses that want to locate in California or stay and grow in. For the first application period 150 million is available for allocation.

We last updated the California Competes Tax Credit in February 2022 so this is the latest version of Form 3531 fully updated for tax year 2021. It has a 6 year carryover and you must meet hiring or investment goals to continue to claim the. Use form FTB 3531 California Competes Tax Credit to report the credit amount for the current year the amount to carryover to future years and any amount recaptured.

916 322-4051 10 Governors Office of usiness. Come to California 2. 180 million in each fiscal year 2018-19 through 2022-23.

If a taxpayer does not have sufficient tax liability in a year with a credit installment there is a six-year carryforward period to utilize the credit. Number of jobs created or retained Compensation paid to employees Amount of investment Duration of. 780 million for 5 years of credits - 30 million 201314.

Use form FTB 3531 California Competes Tax Credit to report the credit amount for the current year the amount to carryover to future years and any amount recaptured. California Competes Tax Credit Continued Credit awards are based on 12 factors. The California Competes Tax Credit is an income tax credit available to businesses that want to.

This credit is available for businesses that want to. 140M Available in Tax Credits. Value of the Individual Credit.

March 7 2022 through March 28 2022 1047 million plus any remaining unallocated amounts from the previous application periods Applications for the credit will be. California Competes Tax Credit Apply. 200 million 2015-16 2016-17 2017-18.

California Competes Tax Credit Relocation Credit Los Angeles Cpa

California Expands Salt Workaround And Repeals Nol And Business Credit Limits Weaver

Review Of The California Competes Tax Credit

California Competes Tax Credit Relocation Credit Los Angeles Cpa

California Competes Tax Credit Relocation Credit Los Angeles Cpa

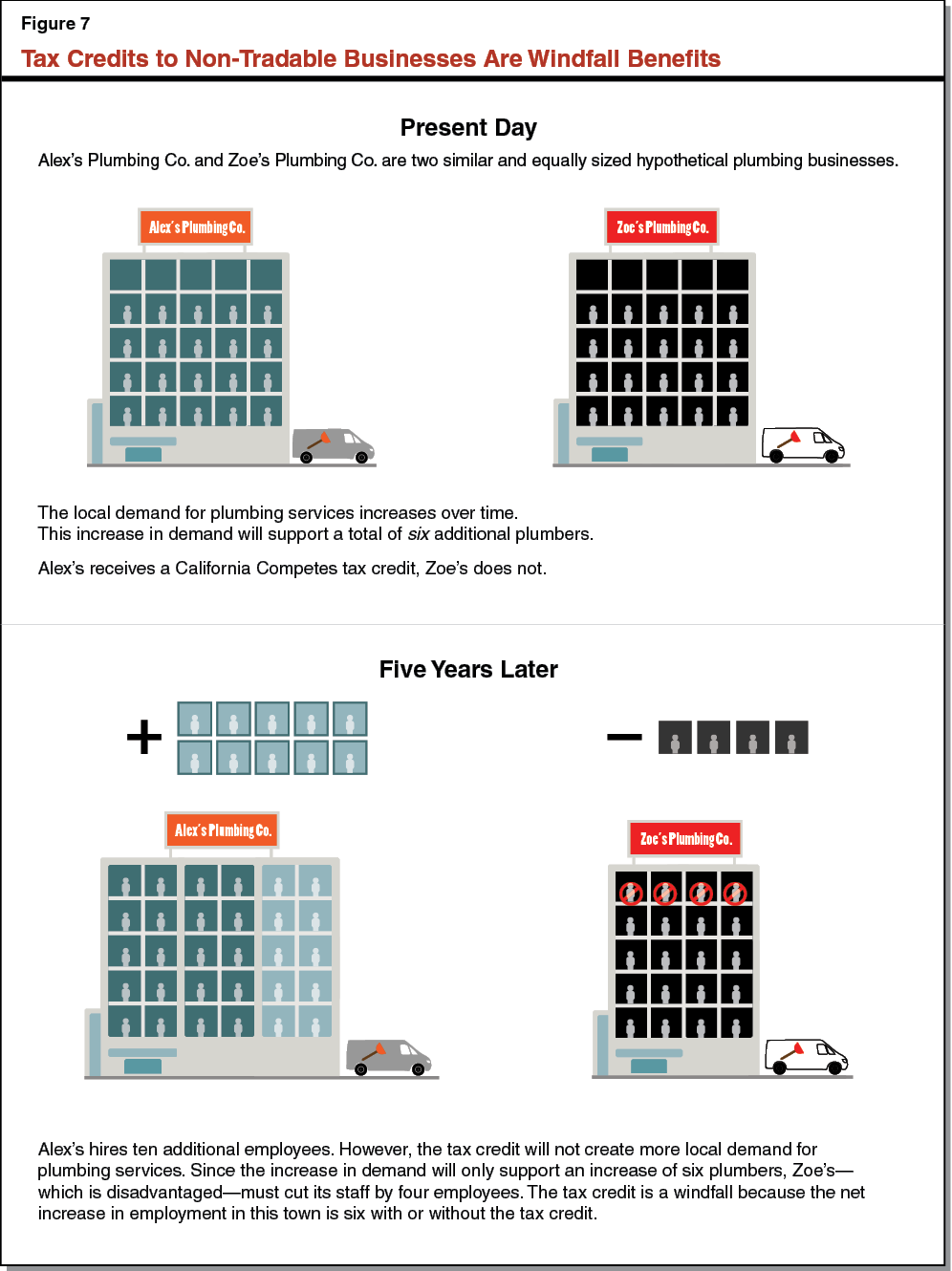

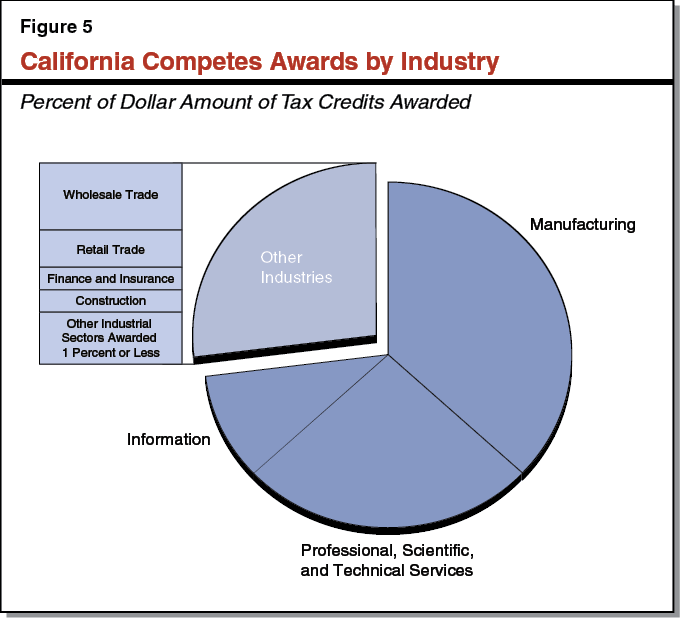

Review Of The California Competes Tax Credit

California Incentives Tax Credits And Exemptions Central California

Funding California Competes Tax Credit And Creation Of The California Competes Grant Program Holthouse Carlin Van Trigt Llp

Tax Season 2020 New Challenges And California S Response

Final Course Exam California 2 5 Docx Question 21 Question Text Which Of The Following Statements Regarding The California Competes Tax Credit Is Course Hero

California Competes Tax Credits For Your Business Youtube

Reliant Tax Consulting Inc Other Tax Credits Incentives

Funding California Competes Tax Credit And Creation Of The California Competes Grant Program Holthouse Carlin Van Trigt Llp

Review Of The California Competes Tax Credit

California Competes Tax Credit Relocation Credit Los Angeles Cpa

Review Of The California Competes Tax Credit

California Competes Tax Credit Relocation Credit Los Angeles Cpa